Advisor Growth Webinar Series

Upcoming Webinars

Streamline Client Philanthropy with The New Strategic Giving Plan Template

August 7, 2024 @ 1PM Eastern

Empower your clients to achieve their philanthropic goals with a structured approach.

Join us for a webinar exploring our new Strategic Giving Plan Template, designed for financial advisors.

In this session, you'll learn how to:

- Leverage the template to facilitate impactful client conversations about charitable giving.

- Guide clients through defining their philanthropic vision and aligning their giving with their values.

- Explore various giving methods (direct donations, foundations, trusts, etc.) and tailor recommendations to client needs.

The Strategic Giving Plan Template offers:

- A framework for building strategic giving plans.

- Customizable sections to personalize the plan for each client.

- Action steps to keep clients moving forward in their philanthropic journey.

This webinar is ideal for advisors who want to:

- Enhance their client service offerings in the area of philanthropy.

- Deepen client relationships through meaningful conversations about values and giving.

- Equip clients with the tools and knowledge to make informed philanthropic decisions.

Register Today!

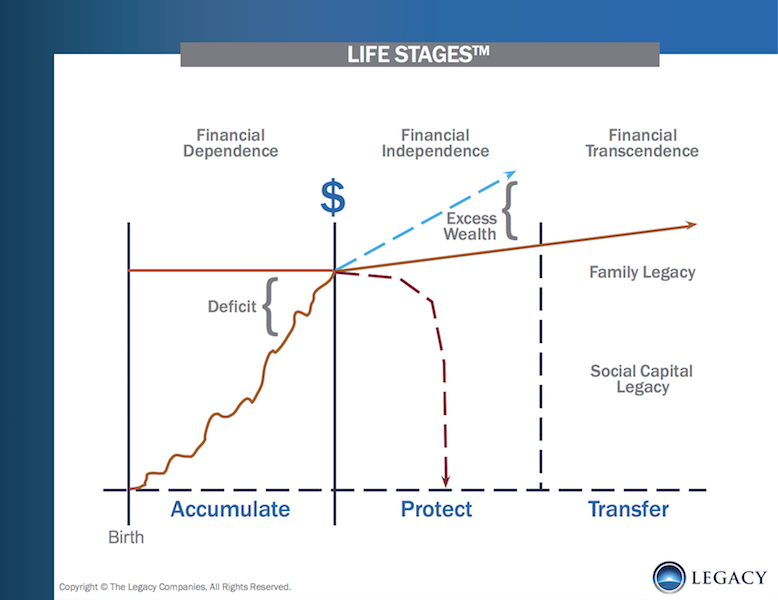

- Understand the Life Stages Framework: Discover the three key stages – Financial Dependence, Financial Independence, and Financial Transcendence – and how they can guide your client conversations.

- Leverage the Video Asset: Legacy clients will learn how to effectively integrate the Life Stages video into marketing strategies to attract new clients.

- Facilitate Meaningful Discussions: We'll provide practical guidance on initiating conversations about the Life Stages with your existing clients.

Register today!

On-Demand Webinars

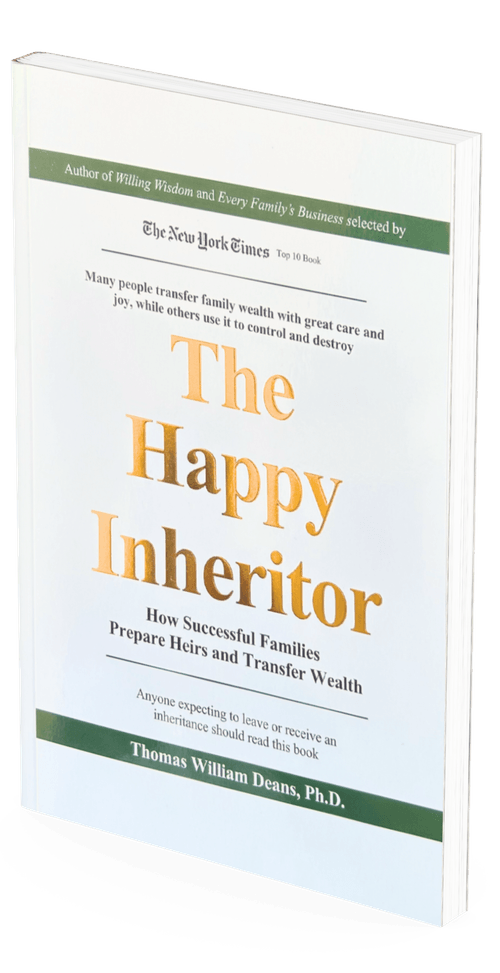

The Happy Inheritor: Preparing Heirs and Transitioning Family Wealth with Dr. Tom Deans

Dr. Tom Deans, acclaimed author and thought-leader on family wealth transfers will join us and delve into insights from his latest book, The Happy Inheritor: How Successful Families Prepare Heirs and Transfer Wealth.

In this session, Dr. Deans will explore the critical role of facilitated family meetings in ensuring smooth and successful wealth transitions. Drawing from his extensive experience and groundbreaking research, he will challenge conventional wisdom and provide actionable strategies for preparing heirs and protecting family wealth across generations.

Dr. Deans is the author of three best-selling books on family wealth, including Every Family’s Business, the best-selling family business book of all time, and Willing Wisdom, which tackles the complexities of legal wills. With over two million copies of his books sold worldwide and having delivered more than 2,000 speeches in 28 countries, Dr. Deans is a preeminent expert on intergenerational wealth transfers.

Prepare to unlearn everything you thought you knew about transitioning family wealth and discover new, effective approaches for your clients.

Combatting Loneliness: Building Community in the Financial Advisor Profession

Join Todd Fithian for a webinar on overcoming loneliness in the financial advisor profession. Many advisors grapple with isolation despite being surrounded by clients and colleagues. Todd will delve into the root causes of this loneliness, including the pressure of shouldering clients’ financial burdens, making critical decisions solo, and the absence of a supportive community to share experiences with.

Discover practical strategies for building a supportive community, including joining industry associations, finding mastermind groups, networking strategically, and seeking mentorship or coaching. Todd will also introduce Legacy's Study Group, a community for financial advisors to share experiences and support one another. If you're looking to enrich your professional life, this webinar is for you.

The Value-Driven Wealth Process from 'The Right Side of the Table' book

Join Todd Fithian, author of "The Right Side of the Table," for an exclusive webinar tailored for financial advisors. Discover the transformative process outlined in Todd's book, designed to help you align your clients' wealth strategy with their core values, vision, and life goals.

Vision: Learn how to identify and support your clients' long-term aspirations, whether it's retiring early, starting a business, or funding their children's education.

Values: Understand how to integrate your clients' principles and beliefs into their financial decisions, from charitable giving to lifestyle maintenance to leaving a lasting legacy.

Goals: Gain insights into setting specific, measurable objectives that align with your clients' vision and values, whether they're short-term (e.g., saving for a vacation) or long-term (e.g., buying a home).

This webinar will provide practical steps to integrate values-based planning into your practice, ensuring that your clients' financial plans reflect what truly matters to them. Whether you're looking to enhance your client relationships, differentiate your services, or simply elevate your practice, this webinar will equip you with the tools and strategies to achieve your goals with purpose and passion.

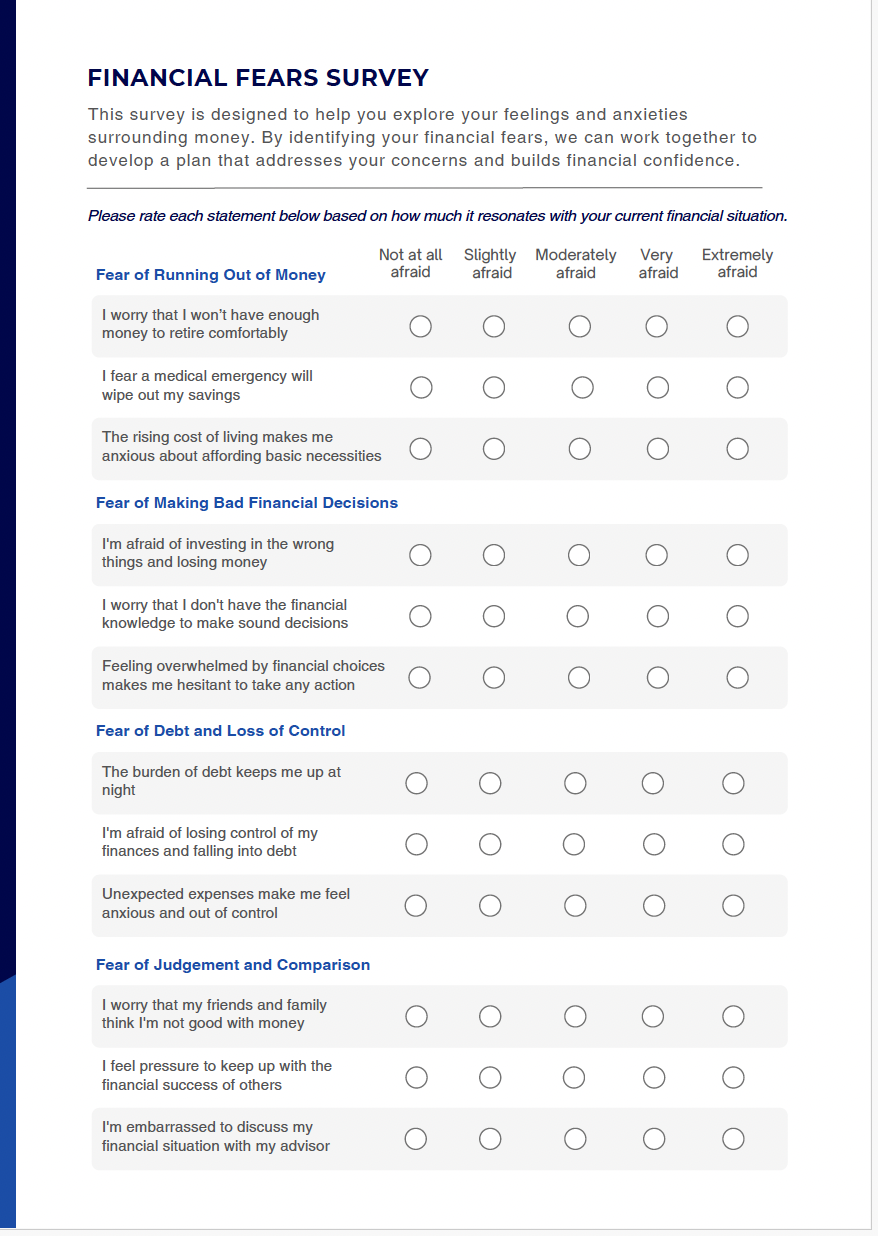

Empowering Your Clients to Overcome Financial Fears

In this webinar we talk about our latest tool, "The Financial Fears Survey". Some things covered are:

- Identifying common financial fears among clients

- Strategies to initiate meaningful conversations about financial concern

- Utilizing survey insights to tailor financial plans and recommendations

- Building trust and rapport by addressing client anxieties proactively

Listen to learn how the Financial Fears Survey can empower you to address your clients' anxieties and build stronger relationships.

Process Matters: How Lacking a Process Can Stunt Your Growth as a Financial Advisor

Join us for a deep dive into the critical role of how a lack of process can prevent growth. We'll explore common areas where advisors often lack processes, including sales, client experience, and onboarding, and discuss how these deficiencies can hinder growth.

Learn practical strategies for implementing effective processes that can streamline your workflow, enhance the client experience, and drive sustainable growth for your practice.

Setting the Right Expectations: How to Avoid Time-wasting Behaviors in Client Interactions

This webinar is on the power of setting expectations in client interactions. We'll discuss common pitfalls where advisors unintentionally set wrong expectations, leading to behaviors such as clients being late or unprepared for meetings.

Learn strategies for effectively managing client expectations to foster a more productive and respectful working relationship. Discover how setting the right expectations can save time, improve efficiency, and enhance the overall client experience.

Goal Clarity in Financial Planning: Helping Clients Define Their Objectives

In this webinar, we tackle the challenge of goal-based planning when clients are not crystal clear on their objectives. Discover why advisors must help clients articulate their goals before offering solutions.

Gain insights into effective techniques for uncovering and refining client goals, allowing you to provide tailored financial solutions that truly align with their aspirations. Elevate your practice by mastering the art of goal clarity in financial planning.

Unlocking the Secrets to Owner Readiness: Beyond the Financials

In this fast-paced, engaging session, you’ll get a ‘behind the scenes’ look at how to prepare an owner for the non-financial aspects of succession and exit. Building on the principles outlined in Abby Donnelly’s recent book, ‘An Insider’s Guide to Succession and Exit’ you’ll learn:

- Why owners struggle when preparing for an exit -- and the one challenge every owner will face.

- How to help them through the difficult decisions and tough conversations that come with succession and exit.

- Which factors get in the way of owner readiness and what to do to help them break through the barriers and create a successful transition.

By the end of the session, you’ll have a fresh perspective and insight into the leadership, interpersonal, and cultural dynamics that impact owner (and successor) readiness as well as strategies you can use to help owners exit well.

Three-Tier Marketing

Learn the three strategic tiers you can apply to every networking or marketing event that is guaranteed to grow your business.

Leveraging Chatbot GPT for Advisor Marketing Success

Discover how financial advisors can harness the power of Chatbot GPT to supercharge their marketing strategies. This webinar is designed to equip advisors with practical insights on leveraging Chatbot GPT technology for crafting impactful marketing plans that engage clients effectively.

Key Takeaways:

- Introduction to Chatbot GPT for Non-Techies: Simplifying the understanding of Chatbot GPT's role in marketing without technical jargon.

- Boost Client Engagement: Learn practical ways to use Chatbot GPT to engage clients, answer FAQs, and provide instant support, enhancing customer experiences.

- Personalize Marketing Efforts: Explore how to personalize marketing campaigns using Chatbot GPT, delivering tailored content that resonates with individual client needs.

- Automation Made Easy: Discover user-friendly approaches to automate routine marketing tasks with Chatbot GPT, saving time and effort.

- Targeted Client Interaction: Understand how to use Chatbot GPT to segment clients and target specific audiences with precision, improving marketing ROI.

Who Is This For: Financial advisors and professionals eager to explore the practical applications of Chatbot GPT in simplifying and enhancing their marketing efforts.

Unlock actionable strategies to incorporate Chatbot GPT seamlessly into your marketing plan, creating impactful client engagements and driving business growth.

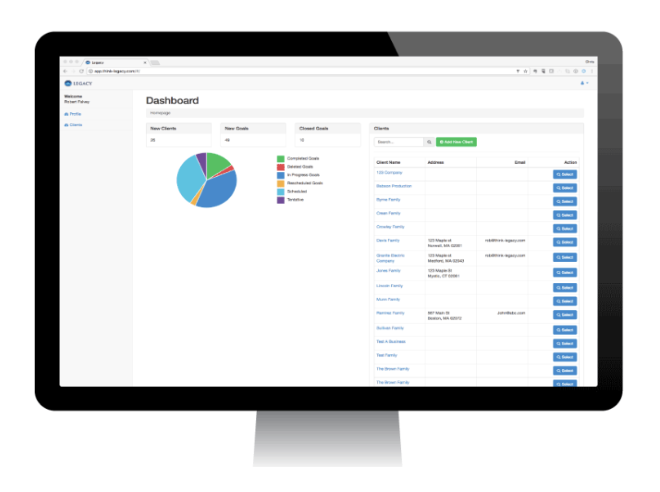

Get Closer to Your Clients: Introducing Qualitate for Financial Advisors

Ever wondered how to understand your client's vision and goals beyond

the numbers?

Join us for an exciting webinar where we unveil Qualitate, an awesome web-based tool designed specifically for financial advisors like you!

We'll show you how Qualitate makes capturing and understanding your client's unique visions, values, and goals a breeze. No more struggling to document those insightful client conversations—Qualitate has got your back!

We'll explore how this tool helps you prioritize goals, create actionable plans, assess your client's team, and even analyze their risk preferences. It also has access to our industry-leading questionnaires.

Say hello to a smoother, more insightful client-advisor relationship with Qualitate.

Come dive into a new world of personalized financial strategies!

Planning for Prosperity: A Financial Advisor's Guide to Generational Wealth

The single greatest risk to your business is a lack of generational reach. When your current clients die and their assets move to the next generation, those clients will leave you (the odds are 90% against you). And it’s worse - 70% of estate plans fail and cause the family to lose their wealth because of family cohesion challenges: they fight, and then they go broke.

Educating and guiding generations of families through wealth and legacy planning can be challenging, we’ll show you how Legacy leverages the industry’s best process, tools, and language to ensure a strong connection to the next generation and the transfer of wealth; so not only do the relationships and assets stay in place, but the business value increases.

Navigating the Shift: From Product-Focused to Client-Centric

The industry has often prioritized products over clients.

The truth is advisors will see solutions long before their clients will, which often leads to

product placement before truly understanding their client’s vision, values, and goals.

To make it worse, many of those clients do not have a clear picture of the future they want. Many rely on their credentials, experience, and knowledge to differentiate themselves from the rest. But the best way to differentiate is the way you make your clients feel. Supported, heard, and understood – an advisor who can help them crystalize their vision for the future and bring them closer to their goals will be their advisor for life.

Listen to this discussion on reshaping the financial advisory landscape and discover how Legacy can be your trusted partner through this transformation.

Meeting Plan:

The Problem at Hand: Delve into the challenges of product-centric financial advisory and its impact on clients.

Client-Centric Revolution: Learn about the value of focusing on clients' needs, values, and aspirations.

Legacy - Your Partner for Change: Discover how Legacy can guide advisors ready to embrace a client-centric model.

Overcoming the Practitioner's Dilemma: Evolution from Practice to Business

Are you stuck in the practitioner's dilemma, struggling with day-to-day operations and unable to focus on client relationships and growth?

In this webinar, we address common challenges faced by financial advisors who want to own a business but find themselves immersed in operations.

Learn about proven business structures and strategies that empower you to reclaim your time, support client relationships, and streamline your practice.

Discover the path to efficiency and growth. and learn how Legacy can help you transform your practice into a business that doesn't run you.

Building Trust from the First Conversation: 'The Planning Horizon' Approach

Are you a financial advisor looking to foster deeper client relationships and secure

valuable prospects from the very first conversation?

This webinar covers The Planning Horizon. Studies show consumers are demanding change. Focusing on strategies, tactics, and tools is not a differentiator anymore. Your clients require trust and that starts with understanding who they are, what they want, and what they are trying to build for future generations.

The Planning Horizon conversation can help open trusted relationships from the first conversation and visually show them how your process is different, and client-focused. Mastering the art of starting above the line can redefine your approach. It's about understanding your clients' aspirations, values, and goals upfront, ensuring that you build trust and rapport from the beginning and that they become clients for life.

Mastering Niche Power: Elevating Your Marketing Strategy

On this webinar, Natalie of Natalie Hales Advisor Marketing will join us to talk about niche marketing.

Unlock the potential of niche marketing with this comprehensive step-by-step guide. Learn how to identify your ideal audience and create a highly effective strategy to serve them. Carving out your niche is the fastest way to grow a book of engaged clients who trust your expertise and are open to your suggestions. Move forward confidently with a long-term strategy that transforms your business perspective and craft a brand that resonates with your ideal clients. Discover the secrets to building a loyal client base and get the clarity you need to attract aligned, profitable clients through “Mastering Niche Power”.

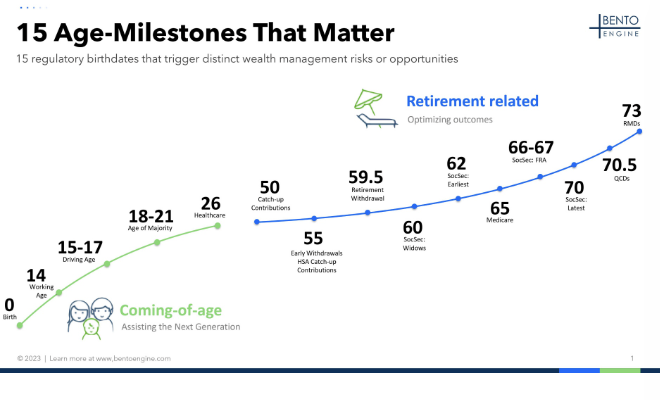

Being High Touch by Being High Tech

Philipp Hecker of Bento Engine was our guest speaker to talk about how advisors can be more high touch by being more high tech.

Technology will not replace the human advisor. But human advisors embracing and leveraging technology will replace those that don't. Join us for deep insights and practical tips around:

- How to be thoughtfully proactive during dozens of "Moments That Matter" on the life journeys of your clients and prospects

- The power of timing -- when to best reach out on what topic

- The importance of picking the right mode of communication -- how to pick the best mode of communication on a client-specific basis

Watch this 30-minute webinar to learn more.

Unlocking Deeper Connections: Discover Your Clients' Passions

Are you ready to elevate your financial advisory game and forge connections that last a lifetime? This session will show you how to take your client relationships to a

whole new level.

In this session, you will learn:

The Art of Delving Deeper: Uncover the interests that go beyond the balance sheet, and gain insights into your clients' passions, hobbies, and aspirations.

Building Bonds That Count: Learn how to use this knowledge to tailor your financial advice and create personalized strategies that resonate with your clients.

Mastering Client-Centered Planning: Uncover Hidden Insights with the Legacy Questionnaire

We have a powerful tool that will take your financial advisory practice to the next level.

This webinar will introduce you to our Legacy Questionnaire—a game-changing resource designed to help financial advisors like you gain deeper insights into your clients' unique financial goals.

During this webinar, you will:

- Learn how the Legacy Questionnaire goes beyond traditional financial planning, allowing you to discover your client's passions and long-term objectives.

- Harness the power of personalized information to create custom-tailored financial strategies that align with your client's goals.

- Learn how to strengthen your client relationships by understanding their values and non-financial interests

Most Advisors Only Scratch the Surface of Discovery

Many advisors we meet would like to think they do in-depth discovery. The truth is many are just scratching the surface. It begs the question, if advisors’ clients are not crystal clear on what they want in the future, how are advisors coming to the table with solutions that aren’t pre-packaged?

Our discovery process starts with advisors taking the time to understand the client’s needs and aspirations at a profound level, which ultimately paves the way for meaningful action.

In this session, we will outline the key components of the discovery process and show you how you can easily get access to it and implement it into your business immediately.

Attract HNW Clients Qualitatively

The goal of a Financial Advisor is to help clients achieve their financial dreams. But to truly make a difference in their lives, it's important to go beyond just providing resources, products, and strategies. Being qualitative means putting your client's best interests above your own and taking a holistic approach to understand what truly matters to them.

In this webinar, we explore the power of being qualitative, and why intentional listening, empathy, and communication are key components of a successful financial advisor-client relationship.

Listen to this session on how to prioritize your client's needs and aspirations and create a truly impactful and meaningful partnership.

The First Meeting Confidence Test: How Prepared Are You for Prospects?

Advisors spend dollars, time, and effort attracting their perfect prospect, and then simply wing it as they walk through the door. More oftentimes than not successful advisors can work through it…but what if you had the consistency to nail it every time? In this session, we'll cover key aspects of our Approach Talk. You'll learn:

- The importance of a consistent approach

- Why you need to shift your focus from tactics to understanding

- The power of active listening

- How Legacy can help you deploy strategies to maximize conversion rates and foster long-term client relationships

Listen now to learn how to revolutionize your client engagement approach.

10 Client Facing Tools in 20 Minutes

We're thrilled to showcase a suite of cutting-edge client-facing tools that are revolutionizing the way advisors engage with their clients.

During this session, we'll delve into a range of powerful tools that empower advisors to deliver exceptional financial planning experiences. From streamlining processes to uncovering critical insights, these tools are instrumental in cultivating trust, understanding client needs, and designing tailored strategies.

Our lineup of tools includes:

1. The Planning Table

2. Complexity Threshold Index

3. Strategy Risk Tolerance

4. The Legacy Questionnaire

5. The Business Questionnaire and Family Business Questionnaire

6. The Family Questionnaire

7. The Planning Horizon

8. Values Cards

9. Marketing Video Asset for your website (The Planning Horizon)

10. Marketing Video Asset for your website (On your process)

Discovering Your Client's Values: A Financial Advisor's Guide to Building Stronger Relationships

As a financial advisor, your job is to help your clients achieve their financial goals. But in order to truly understand their vision for the future, it's important to understand their values and the experiences that have shaped them.

In this webinar, we walk you through the Legacy Values Cards exercise, a powerful tool that will help you uncover your clients' values and beliefs. By the end of this session, you'll have the skills to build stronger, more meaningful relationships with your clients and help them achieve their financial goals in a way that aligns with their values and vision for the future.

The Secret to Client Decision Making

The GISOR Model is designed to help clients identify, prioritize, and act on what is most important to them. Understanding the Goals that a client wants to accomplish will help you in the estate and wealth transition process by tying their Goals to the larger picture of their family.

Come learn more about our GISOR Model in this brief 20-minute session.

Active Promoters & The Legacy Introduction Process

There’s a large degree of difference between those who can and will promote, and those who can but won’t influence introductions.

We’ll delve into the difference between the two while providing you with some proven techniques that will increase the number of introductions you get.

Our clients who have deployed our approaches to their client engagement have increased the number of introductions they receive on average by 58%. Asking matters, but having a strategy for asking makes the difference.

Supercharge Your Growth and Marketing With Video

As you look to differentiate, emphasize the human side, and attract more of your ideal clients, no medium is more effective than video. Whether you operate in person, virtual or hybrid, leveraging authentic and impactful video in your marketing is easier than ever.

In this session, Katie Braden of Advisor Video Marketing will show you exactly how to get started today, how to maximize your ROI early on, and why a few minutes of video creation each week could be the best investment you make in your business - and yourself - this year.

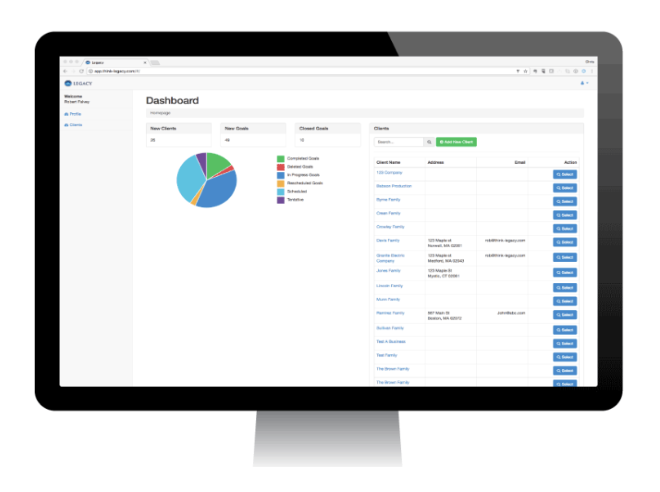

Client Deliverables that Avoid Indecision

Come learn how Qualitate, the innovative qualitative software for financial advisors, can help you eliminate client indecision.

Qualitate combines traditional financial and estate planning tools with advanced qualitative discovery to understand your client's wants, desires, and priorities, helping you create powerful client relationships.

We'll show you how Qualitate enables you to provide customized presentations personalized to your client's needs, helping them make decisions quickly and confidently.

With Qualitate's easy-to-access sections, you can progressively build out your client profile over time, ensuring that you have all the information you need to make informed recommendations.

Watch now to discover how Qualitate's qualitative approach can enhance your client experience and lead to successful outcomes.

Cracking the Code on Working with 3rd Party Professionals

Many advisors we meet would agree that working with 3rd party professionals has historically been a one-sided transaction.

Reciprocation is rare and identifying the true active promoters for you and your business can be hard to find.

In this session, we focus on how you can identify those active promoting 3rd party professionals and how you can open the door for them to facilitate business.

Your Best Client is Their Best Prospect

At Legacy, we're strong believers that the relationship is the one thing that cannot be commoditized.

We all work in the relationship business, but oftentimes we take for granted the strategy behind building relationships.

Meanwhile, your best client is another advisors best prospect – which opens the opportunity for someone to poke holes in your work, or even worse, take all of your hard work over.

Join us on March 14 for a brief 30-minute session and we'll show you how to avoid this once and for all.

The Resilient Family: Why resilience plays a critical role in client engagements and what you can do about it

A family's financial capital is better preserved when its family capital is resilient. Why? Because resilient families communicate better, are better at making decisions, and stay connected to each other even through setbacks and challenges.

In this webinar, Kristin MacDermott of The MacDermott Method give advisors an overview of the four components of resilient families who thrive across generations. She also provides an assessment tool advisors can use to help families pinpoint and strengthen areas of weakness while leaning into areas of strength. When advisors offer families concrete steps they can take to become more resilient and grow closer as a family unit, families are more engaged and more appreciative of their advisor. In addition, the advisor can form relationships with NextGens and have a lasting impact on the family's future.

How do you Identify your Ideal Client?

Failing to know who your ideal client is, is often where advisors go wrong when it comes to marketing.

Oftentimes, advisory firms operate their companies for years without truly knowing who their ideal audience is, questioning why the sales process always remains so hard and why it never seems to flow.

The more you know your ideal client, the easier it will be for you to create content that speaks directly to them. When a potential client feels like you "get them," your offer becomes much more appealing. (And when it comes to selling vs. marketing, you can sell to whomever you want!)

Demonstrate your Difference with the Legacy Approach Talk

Most advisors like to say they are different, but this is your first opportunity to demonstrate that difference. By using The Planning Horizon® and The Wealth Optimization System®, you can provide a concrete explanation to clients that your well-thought-out approach will help them clarify what they want so they can achieve their desired results.

Listen to the recording to learn more about how we can help you stand out in a crowded marketplace.

Marketing with Purpose

It’s early in the year and we’ve all set goals for ourselves.

How many prospects do you need to find? Out of those how many will you close? The math behind our production plan builder is simple, but it can speak volumes about what is needed to be done to meet your personal income goal.

At Legacy, that goal is non-negotiable. Do you know how we can be sure you hit it?

In this session we will break down the Production Plan Builder and help you get closer to your goals.

Differentiate Your Client Deliverables

The Financial Life Stages

Learn how to open up conversations with your HNW and UHNW Clients and Prospects with our Life Stages talk and unlock endless possibilities for planning.

With Passcode 8DtXb.rE

The Power of First Impressions: The Bridge Talk

The moment where your activity and the quality of your relationships intersect is when you first meet a potential client. The moment that you sit down and start to have “the conversation,” is the make-it-or-break-it moment. It doesn’t mean that there aren’t other factors that will affect your career, but when you first meet, that’s when the magic happens.

Forget the Elevator Pitch and learn how to effectively use our Bridge TalkTM to differentiate yourself from the first interaction.

The 4 Decisions Clients Must Make to Prevent Them From Getting Stuck or Stalled

To Charge a Fee or Not to Charge, That is the Question

There is an ongoing debate with regard to an AUM Model, Fees for planning, or Hybrid. Regardless of where you are today, or where you want to be in the future, there are roads that need to be navigated.

Listen now to Co-Founder and Managing Partner, Todd Fithian.

With Passcode H4jX#+8c

Differentiate your Planning with Qualitative Discovery

The reality is, planning and planning deliverables all look relatively the same to clients, but they don't have to. The leading advisors of the future will lead with a truly qualitative approach to discovering the client's desires and intentions.

Learn how uncovering your client's Values, Vision, and Goals for the future not only creates an entirely different client experience but unlocks endless opportunities for your services.

With Passcode Af.O54Uv

Learn the Secret to Creating High Trust Relationships, Every time

With Passcode @i3@2n@Q

Staying out of the Weeds of Operations

We consistently hear from advisors that say they oftentimes ebb and flow between production and operations. Usually, the days spent doing operations are agonizing. Let us show you a structure that can help solve that.

Learn a business structure that can deliver better results, easier and faster. This isn't just any old organization chart. Delineate the productivity and operations of your business so everyone is on the same page.

Listen to this webinar as we cover our Advisor Business Org Chart to learn to keep advisors "out of the weeds" of operations for good.

With Passcode Q7XG51G*

Navigating Your Client's Planning Table

Every advisor has experienced having their work reviewed by another advisor, and sometimes without their knowledge.

Either way can be detrimental to forward progress.

Listen to this webinar to learn how The Planning Table Conversation and tool will help you uncover all the key and important relationships influencing clients' decision-making and poking holes in your work.

How to Become Referable

Referrals are an important part of any financial advisory business. Asking for referrals, though, has historically been challenging. In this webinar, we'll show you how to do it effectively once and for all.

With Passcode .Eb9nzQ8

Creating your Tangible Marketing Plan

Creating a clearly defined marketing strategy for your business is critical to driving the highest results possible, and putting a plan in place will ensure you have the best year ever. However, if you're like many of our clients, knowing where to start is often the challenge.

With Passcode g1aWa%ms

Already a Legacy member? Click below to see our full list of events and get access to our library of on-demand webinars.

Not a member? Click below to book a time with Mike.